Understanding Artificial Intelligence in Finance

AI involves using advanced algorithms and machine learning to simulate human intelligence. In finance, AI systems analyze massive amounts of data to identify patterns, make predictions, and optimize decisions. The integration of AI into financial planning allows individuals and businesses to navigate their financial journeys with greater confidence.

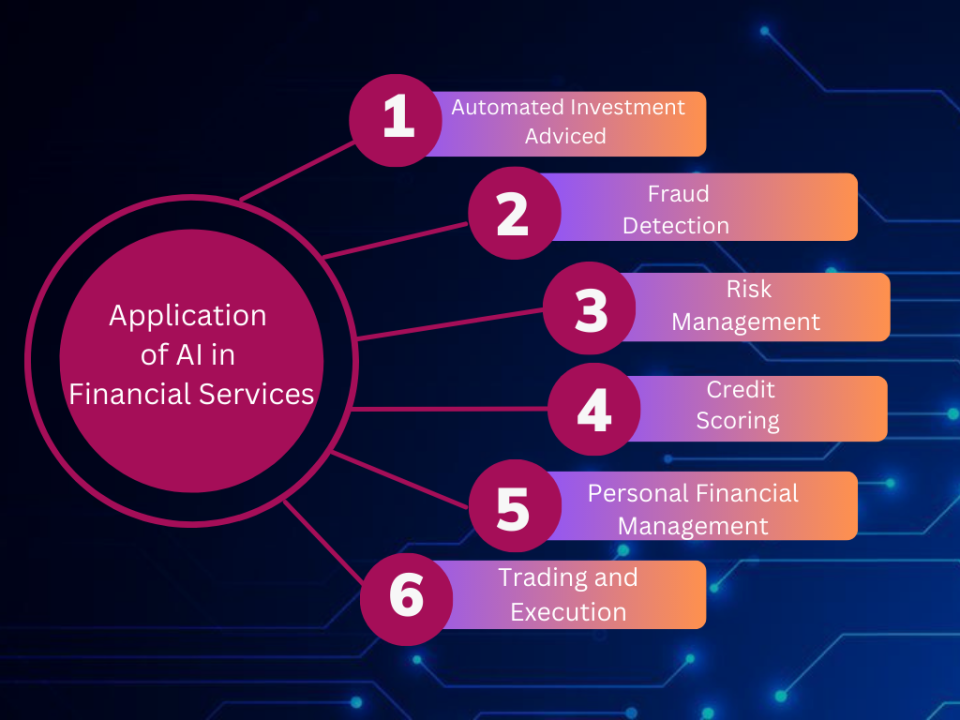

Applications of AI in Financial Planning

1. Automated Budgeting Tools

AI-powered budgeting apps, like Mint and PocketGuard, help users manage their income and expenses by analyzing spending patterns and suggesting tailored plans. These tools adapt over time, offering real-time adjustments to ensure financial goals are met.

2. Robo-Advisors for Investment Management

Robo-advisors, such as Wealthfront and Betterment, use AI to provide personalized investment advice. By analyzing risk tolerance, financial goals, and market trends, they create and manage diversified portfolios with minimal human intervention.

3. Financial Forecasting

AI systems excel at forecasting future financial scenarios. They predict market trends, simulate various investment outcomes, and help businesses and individuals prepare for uncertainties.

4. Risk Assessment

AI enhances risk management by evaluating financial data and identifying potential threats. For example, AI algorithms can detect fraudulent activities and suggest measures to mitigate risks.

5. Tax Optimization

AI tools simplify tax planning by identifying deductions, optimizing filing strategies, and minimizing liabilities. These tools are particularly useful for freelancers and small businesses.

Advantages of AI in Financial Planning

1. Improved Accuracy

AI eliminates human errors in calculations and decision-making. With precise data analysis, users can make more informed financial decisions.

2. Cost Efficiency

AI tools reduce the need for costly human advisors, making financial planning more affordable for individuals and small businesses.

3. Personalization

AI adapts to individual preferences and financial situations, offering customized solutions that align with unique goals.

4. Accessibility

AI-powered platforms make financial planning tools available to anyone with a smartphone or computer, democratizing access to financial advice.

Challenges of Using AI in Financial Planning

1. Data Security Concerns

AI relies heavily on sensitive financial data, raising concerns about privacy and cybersecurity. Robust measures are needed to protect user information.

2. Ethical Considerations

AI systems can inherit biases from their training data, leading to unfair financial recommendations or decisions.

3. Dependence on Technology

Excessive reliance on AI may reduce financial literacy and critical thinking, as users trust automated systems over personal judgment.

4. Limited Human Insight

While AI excels at data analysis, it may lack the empathetic understanding that human financial advisors provide.

The Future of AI in Financial Planning

1. Predictive Analytics

AI-driven predictive analytics will become increasingly sophisticated, enabling users to anticipate financial trends and make proactive decisions.

2. Blockchain Integration

Combining AI with blockchain technology enhances transparency and security, creating more trustworthy financial systems.

3. Hyper-Personalization

AI will evolve to offer hyper-personalized financial plans, incorporating real-time data and individual preferences with unparalleled precision.

4. Widespread Adoption

As AI technology becomes more accessible, its integration into everyday financial planning will grow, benefiting users across socioeconomic backgrounds.

How to Leverage AI for Better Financial Planning

1. Choose Reliable Tools

Select AI-powered tools that align with your financial needs. Whether it’s budgeting, investment management, or risk assessment, ensure the platform is reputable and secure.

2. Combine AI with Expert Advice

While AI tools are powerful, human financial advisors can provide nuanced insights that technology might miss. Use AI as a supplement rather than a replacement.

3. Stay Informed

Understand the capabilities and limitations of the AI tools you use. Staying informed helps you make the most of their features while avoiding potential pitfalls.

4. Monitor Performance

Regularly review the performance of AI-driven financial strategies to ensure they meet your expectations and goals.

Conclusion

Artificial Intelligence is revolutionizing financial planning, offering unparalleled efficiency, personalization, and accessibility. While challenges such as data security and ethical concerns must be addressed, the benefits of AI outweigh its limitations. By leveraging AI tools and staying informed, individuals and businesses can take control of their financial futures with confidence.

FAQs

1. What is the role of AI in financial planning?

AI simplifies and enhances financial planning by automating tasks like budgeting, investment management, and risk assessment.

2. Are AI-powered financial tools secure?

Most reputable AI tools prioritize data security. However, users should verify the platform’s privacy policies and use strong security practices.

3. Can AI replace human financial advisors?

AI complements human advisors but may not replace them entirely, as human insight and empathy remain critical in financial planning.

4. How can businesses benefit from AI in financial planning?

Businesses can use AI for accurate forecasting, risk management, and cost optimization, leading to better financial decision-making.

5. Is AI suitable for personal finance management?

Yes, AI-powered tools are ideal for managing personal finances, offering tailored advice and real-time solutions.