Taxes are a fundamental part of financial life. Whether you’re a salaried employee, a freelancer, or a business owner, understanding how taxes work can help you save money, reduce liability, and maximize your refund. By knowing the rules, utilizing deductions, and planning strategically, you can make tax season less stressful and more rewarding. This article provides actionable tips and insights to help you navigate the complexities of taxes effectively.

What Are Taxes and Why Do They Matter?

Taxes are compulsory financial charges imposed by governments to fund public services like infrastructure, education, and healthcare. Individuals and businesses alike are required to file their taxes annually, reporting income, deductions, and liabilities.

Understanding taxes is crucial because:

- It ensures compliance with the law.

- It allows you to take advantage of deductions and credits.

- It helps you plan for long-term financial stability.

Types of Taxes You Should Know About

Before diving into strategies, let’s look at the common types of taxes individuals face:

- Income Tax

- Levied on earnings from wages, salaries, and investments.

- Rates vary based on income level and filing status.

- Property Tax

- Paid on real estate and occasionally personal property.

- Calculated based on property value.

- Sales Tax

- Applied to goods and services at the point of sale.

- Rates vary by state and locality.

- Capital Gains Tax

- Imposed on profits from the sale of investments like stocks and real estate.

- Self-Employment Tax

- Covers Social Security and Medicare contributions for freelancers and small business owners.

How to Maximize Your Tax Refund

Getting a larger refund is a goal for many taxpayers. Here are some effective ways to maximize what you get back from the government:

1. Understand Tax Credits vs. Deductions

- Tax Credits reduce your tax bill dollar-for-dollar. Examples include the Earned Income Tax Credit (EITC) and Child Tax Credit.

- Tax Deductions lower your taxable income. Examples include mortgage interest, student loan interest, and charitable donations.

Tax credits are generally more beneficial than deductions because they directly reduce the amount of tax owed.

2. Claim All Eligible Deductions

Knowing which deductions you qualify for is essential. Common deductions include:

- Education Expenses: Student loan interest and tuition fees.

- Home Office Deduction: For self-employed individuals using a portion of their home for work.

- Medical Expenses: Deduct unreimbursed medical expenses exceeding 7.5% of your adjusted gross income.

3. Contribute to Retirement Accounts

Contributions to retirement accounts like a 401(k) or IRA can reduce your taxable income. In 2024, the contribution limits for these accounts have increased, allowing you to save more while reducing your tax burden.

4. Take Advantage of Tax-Free Investments

Certain investment accounts, such as Roth IRAs and Health Savings Accounts (HSAs), grow tax-free. Contributions may also be tax-deductible, depending on the account type.

5. File Early and Electronically

Filing early reduces the risk of identity theft and ensures you get your refund sooner. Electronic filing is faster and more accurate than paper filing, minimizing errors that could delay your refund.

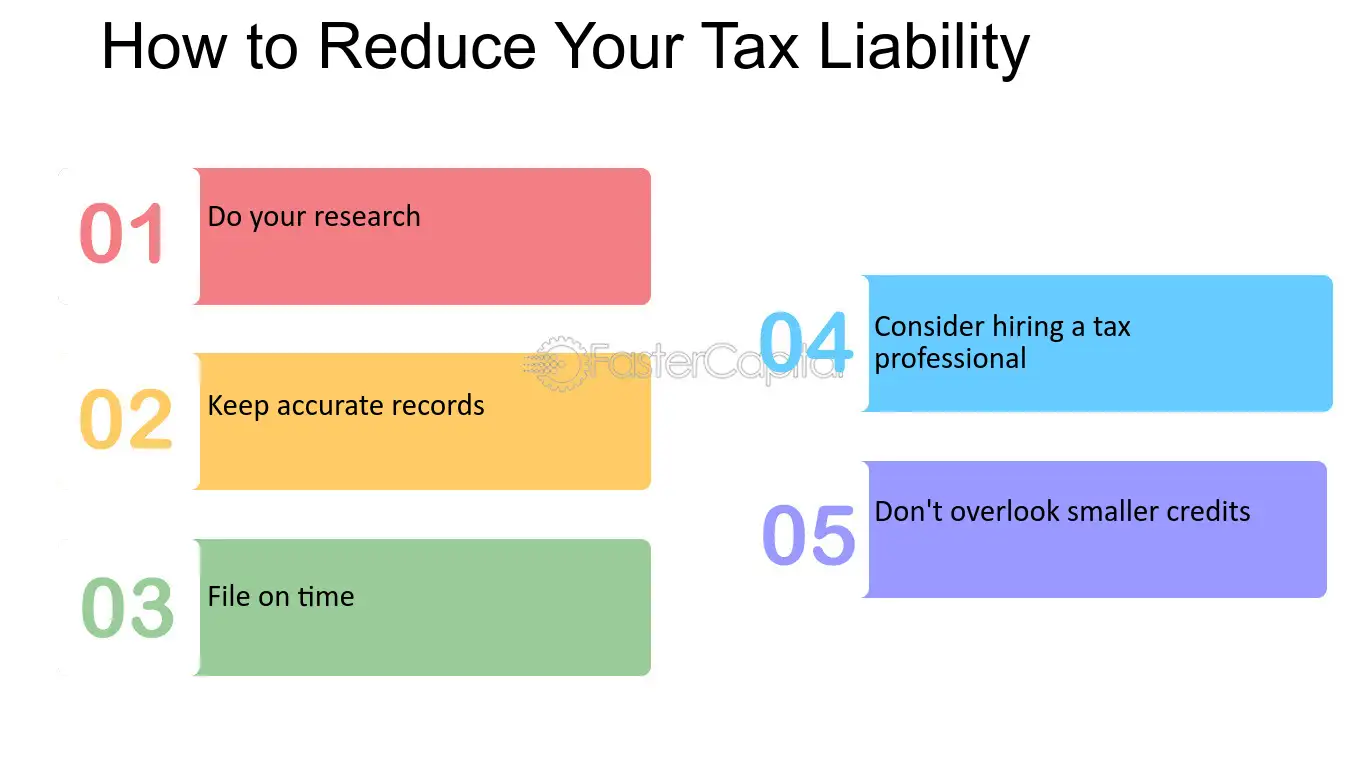

How to Reduce Your Tax Liability

Reducing the amount of taxes you owe requires proactive planning. Here are some strategies to help you keep more of your hard-earned money:

1. Adjust Your Withholdings

If you consistently owe taxes at the end of the year, consider adjusting your W-4 form with your employer. Increasing withholdings ensures that more taxes are taken out of your paycheck, reducing your liability at tax time.

2. Leverage Tax-Advantaged Accounts

Maximize contributions to accounts like:

- 401(k) Plans: Contributions are pre-tax, reducing your taxable income.

- Health Savings Accounts (HSAs): Funds used for qualified medical expenses are tax-free.

3. Harvest Tax Losses

If you’ve sold investments at a loss, use those losses to offset gains from profitable investments. This strategy, known as tax-loss harvesting, can significantly reduce capital gains taxes.

4. Use Business Deductions

Self-employed individuals can benefit from a variety of deductions, including:

- Office Supplies and Equipment: Deduct expenses for tools essential to your work.

- Travel and Mileage: Claim costs for business-related travel.

5. Invest in Energy-Efficient Upgrades

Installing solar panels or energy-efficient appliances in your home may qualify you for energy tax credits, reducing your tax bill while contributing to sustainability.

Tax Preparation Tips for a Smooth Filing Process

Proper preparation can save you time and stress. Here’s how to make the tax filing process seamless:

1. Keep Accurate Records

Maintain organized records of income, expenses, and receipts throughout the year. Use apps or software like QuickBooks or Expensify to track expenses in real-time.

2. Use Tax Software or Hire a Professional

Tax software like TurboTax or H&R Block simplifies the filing process by guiding you step-by-step. Alternatively, hiring a CPA or tax professional is ideal for complex situations.

3. Double-Check for Errors

Mistakes on your tax return can lead to delays or audits. Common errors include incorrect Social Security numbers, math errors, or missing signatures.

4. Monitor Changes in Tax Laws

Tax laws change frequently, affecting deductions, credits, and rates. Stay informed about updates to ensure you’re filing accurately.

5. Plan for Next Year’s Taxes

Tax planning isn’t just for the current year. By making strategic decisions throughout the year, such as adjusting withholdings or contributing to retirement accounts, you can reduce your liability and improve your refund for the following year.

Common Mistakes to Avoid

- Filing Late: Missing the deadline can result in penalties.

- Failing to Report All Income: Ensure you include all sources of income, even side gigs.

- Overlooking Deductions: Don’t miss out on deductions like student loan interest or charitable contributions.

Conclusion

Understanding taxes and employing the right strategies can make a significant difference in your financial health. By maximizing deductions, claiming credits, and planning proactively, you can reduce your tax liability and increase your refund. With proper preparation and the tips outlined in this article, tax season doesn’t have to be a headache—it can be an opportunity to save money and achieve financial goals.

FAQs

1. What is the difference between a tax credit and a tax deduction?

Tax credits directly reduce your tax bill, while deductions lower your taxable income.

2. Can I deduct home office expenses if I’m an employee?

No, home office deductions are only available to self-employed individuals or business owners.

3. What’s the benefit of contributing to a 401(k)?

Contributions are tax-deferred, meaning you won’t pay taxes on the money until you withdraw it in retirement.

4. How can I avoid penalties for underpayment of taxes?

Adjust your withholdings or make quarterly estimated tax payments to avoid underpayment penalties.

5. When is the deadline for filing taxes in 2024?

The deadline for most taxpayers to file their 2023 taxes is April 15, 2024.