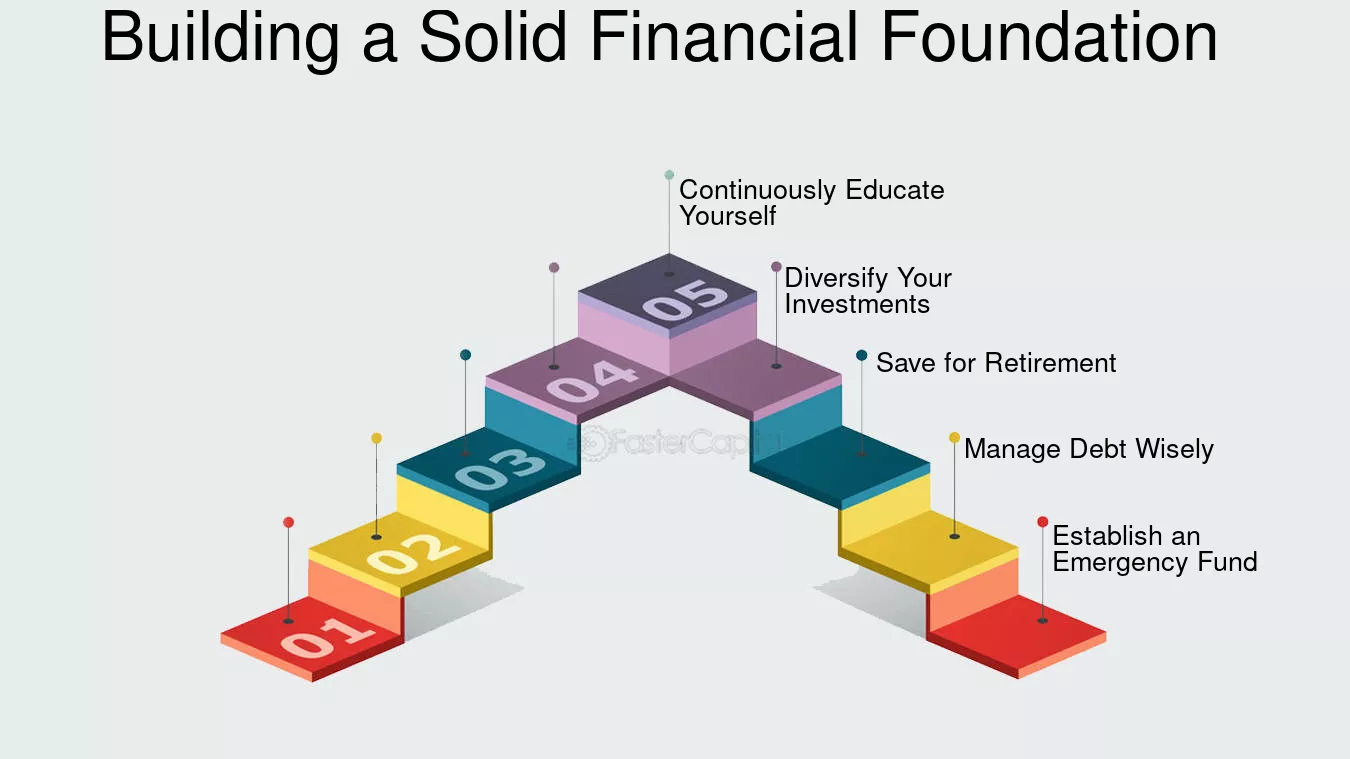

In today’s fast-paced world, managing personal finances has become more critical than ever. Whether you’re looking to save for a big purchase, eliminate debt, or secure a stable retirement, mastering personal finance is the first step towards achieving your financial goals. This comprehensive guide will help you build a solid financial foundation by providing actionable tips and strategies that are easy to follow.

Why Personal Finance Matters

Personal finance encompasses managing your money, including budgeting, saving, investing, and planning for the future. A strong financial foundation helps you:

- Avoid unnecessary debt.

- Achieve financial independence.

- Reduce financial stress.

- Prepare for emergencies.

- Build long-term wealth.

Step 1: Create a Realistic Budget

A budget is the cornerstone of financial management. It helps you track income and expenses to understand where your money is going.

How to Create a Budget

- Track Your Income and Expenses: List all sources of income and categorize your expenses into essentials (rent, utilities, groceries) and non-essentials (entertainment, dining out).

- Set Spending Limits: Allocate a portion of your income to each category. A popular method is the 50/30/20 rule:

- 50% for needs (housing, bills).

- 30% for wants (entertainment, travel).

- 20% for savings and debt repayment.

- Review and Adjust: Regularly review your budget to ensure you’re on track and make adjustments as needed.

Step 2: Build an Emergency Fund

An emergency fund acts as a financial safety net. It prevents you from falling into debt when unexpected expenses arise, such as medical bills or car repairs.

How to Build an Emergency Fund

- Set a Goal: Aim for 3-6 months’ worth of living expenses.

- Automate Savings: Set up automatic transfers to a dedicated savings account.

- Start Small: Even saving $10–$20 per week adds up over time.

Step 3: Eliminate Debt Strategically

Debt can be a major obstacle to financial freedom. Tackling it systematically ensures you stay on the right path.

Debt Repayment Strategies

- The Snowball Method: Focus on paying off the smallest debts first for quick wins, then move to larger debts.

- The Avalanche Method: Prioritize debts with the highest interest rates to save money over time.

- Consolidate Debt: Combine multiple debts into a single loan with a lower interest rate.

Step 4: Save and Invest for the Future

Saving and investing are crucial for achieving long-term financial stability. While saving ensures you have money for short-term goals, investing helps your wealth grow over time.

Saving Tips

- Open a high-yield savings account.

- Set clear goals, such as saving for a vacation or down payment.

- Avoid withdrawing from savings for non-emergencies.

Investment Strategies

- Start Early: The sooner you invest, the more time your money has to grow through compound interest.

- Diversify Your Portfolio: Spread your investments across stocks, bonds, and mutual funds to reduce risk.

- Use Retirement Accounts: Maximize contributions to 401(k)s, IRAs, or similar accounts to benefit from tax advantages.

Step 5: Improve Your Financial Literacy

The more you know about personal finance, the better equipped you’ll be to make sound financial decisions.

Ways to Boost Financial Knowledge

- Read books, blogs, and articles on personal finance.

- Listen to finance-focused podcasts or attend webinars.

- Use budgeting and finance management apps to track spending and savings.

Step 6: Monitor and Protect Your Credit Score

Your credit score plays a significant role in your financial life, affecting your ability to secure loans, credit cards, and even rental agreements.

Tips for a Healthy Credit Score

- Pay bills on time.

- Keep credit card balances low.

- Avoid opening multiple new credit accounts in a short period.

- Regularly review your credit report for errors.

Step 7: Plan for Retirement

It’s never too early to think about retirement. A well-thought-out retirement plan ensures you can maintain your lifestyle in your golden years.

How to Plan for Retirement

- Estimate Retirement Needs: Calculate how much you’ll need based on your desired lifestyle.

- Contribute Consistently: Invest in retirement accounts regularly.

- Seek Professional Advice: Consult a financial advisor to create a tailored plan.

Step 8: Insure What Matters

Insurance protects you from significant financial losses in case of emergencies.

Essential Insurance Policies

- Health Insurance: Covers medical expenses.

- Life Insurance: Provides financial security for your family.

- Home or Renters Insurance: Protects your property and belongings.

- Disability Insurance: Replaces lost income if you’re unable to work.

Step 9: Avoid Lifestyle Inflation

As your income increases, it’s tempting to spend more. However, resisting lifestyle inflation ensures you can save and invest more for the future.

How to Manage Lifestyle Inflation

- Stick to your budget even after a raise.

- Allocate a portion of any additional income to savings and investments.

- Focus on long-term goals rather than short-term gratification.

Step 10: Set Financial Goals

Clear goals provide motivation and direction. Whether it’s buying a home, starting a business, or traveling the world, your goals should align with your financial plan.

SMART Goals Framework

- Specific: Clearly define your goal (e.g., save $10,000 for a down payment).

- Measurable: Track your progress.

- Achievable: Ensure the goal is realistic based on your income.

- Relevant: Align goals with your priorities.

- Time-bound: Set a deadline.

Conclusion

Mastering personal finance is a journey that requires discipline, planning, and consistency. By creating a budget, building an emergency fund, eliminating debt, and investing wisely, you can establish a strong financial foundation. Remember, financial success doesn’t happen overnight—it’s about making informed decisions and sticking to your plan over the long term.

Start implementing these steps today, and watch as your financial health transforms.